Tag Archives: largest

The Largest Disadvantage Of Utilizing Cvv Shop

For instance is synthesized spending on credit score cards similar to real spending? Do folks spend on the same types of things? Are fraud levels related? Part 4 supplies more details. This complementarity is vital for regulators as a result of if the two merchandise had been substitutes regulators might want to ensure consistency in regulation between the merchandise in the identical market or even provide a market design to facilitate the decrease price credit choice (BNPL) to develop in order to extend competition and drive down the costs borrowing in mainstream credit score corresponding to credit cards. So, there’s a risk you will have a a lot decrease pupil loan cost if you retire. When do you suppose I ought to take my retirement almost about the scholar loan? You will probably not suppose twice about these form of orders, though other individuals could nicely. Nevertheless, on this examine, we’ll cowl extra economic indicators that encompass all segments of the economy, namely households, government, and business segments.

Why it’s nice in one sentence: Although it’s the most costly card on our list, the Business Platinum Card from American Categorical offers luxury journey perks similar to airport lounge entry, elite status and much more. Either start a brand new message or open an current one. It’s also key that you work on either making more money or spending less, or each, says Tatiana Tsoir, certified public accountant and creator of Dream Daring, Begin Good. Through experimental outcomes, we present that the ensemble is more practical in capturing uncertainty corresponding to generated predictions. In case you should be extra exact, faucet the dollar quantity to show the decimal places, then faucet the worth after the decimal and rotate the digital crown to adjust. On Apple Watch, tap the Pay button at the underside of a conversation, set the amount, after which swipe the massive “Pay” button to the left to show it into a “Request” button. Wallet & Apple Pay and look for the Apple Money toggle at the highest of the screen. 1. Within the Apple Money card info (in Settings or the Wallet app), go to the information tab.

That cash is then used by default whenever you ship anyone else money with Apple Cash. Yes, Apple Cash is free. Is Apple Cash free? This could free up just a few hundred dollars you can save toward retirement and as you pay off other debts, your savings can increase,” says Kantrowitz. Something else to think about is that delaying retirement age will increase the amount you get from Social Safety each month, which could provide help to better deal with your debts. To get started, open the Settings app, faucet in your Apple ID, after which Household Sharing. It’s basically a particular prepaid card with some financial companies offered to Apple by Green Dot Financial institution. Whereas vClub.tel may activate them nearly anytime throughout the quarter and still get the bonus cash again retroactively on purchases you’ve already made, it’s vital not to overlook the deadline or you’ll lose out on an vital feature of the card.

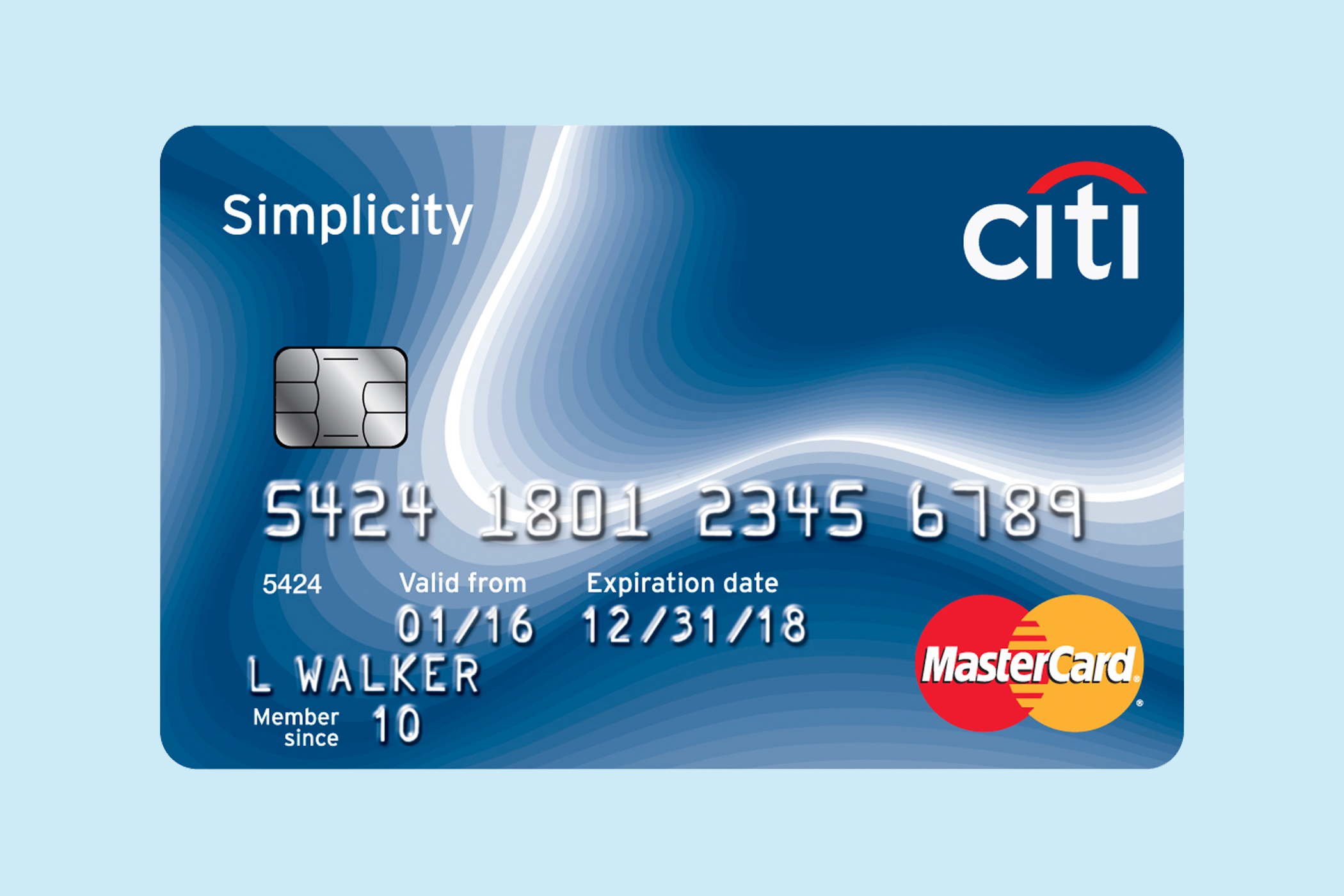

He frantically checks all of his pockets at the checkout while individuals wait impatiently behind him. Lots of people dont know the place is the best place to buy cvv, in a trusted online retailer. Step 1-3: Attempt totally different transformations (e.g., sq. root, exponential, sq., log, etc.) for every lagged indicator and choose the most effective one primarily based on a goodness of match statistic. The engaging 12-month introductory charge of 0% APR makes this card very best for entrepreneurs who need to keep away from interest when financing large purchases or transferring money from one credit card to another. Suppose somebody steals your credit card, and you haven’t notified your bank to stop the card instantly. If you despatched money to someone and so they haven’t but accepted it, you may cancel payment. Tap Cancel Cost. If you don’t see that option, they’ve already accepted the fee. If you don’t want to go down this route then it is recommended that you just don’t. In case you don’t have enough in there, you can pay the steadiness with a debit or prepaid card. “Some or all your medical debt may be able to be negotiated for a lower sum and equally, you possibly can seemingly negotiate a decrease repay quantity to your credit card or refinance the steadiness for a significantly lower interest rate,” says Matson.